Article by Simone Grogan, courtesy of The West Australian.

Hancock Prospecting has deferred part of its plans to tap into the WA magnetite market and delayed a final investment decision on its proposed Ridley mine, pinning the move on approvals uncertainty and water supply.

For the past two years, Gina Rinehart-owned Hanroy has been undertaking studies for its smaller, sister business Atlas Iron to potentially make a mine of the Ridley magnetite deposit east of Port Hedland.

Environmental approval documents were lodged with the Federal Government in early 2023 for a 3 million tonne-a-year starter operation.

Announcing a bumper increase in revenue and a $440 million profit for the last financial year on Friday, Atlas also revealed a feasibility study for Ridley had been completed, but that a final investment call would not go ahead any time soon because of costly and “onerous” approvals.

“Due to approvals uncertainty and uncertainty regarding ground water, the final investment decision has been deferred,” the company said.

”A forward works plan has been implemented to focus on activities to de-risk the project, including to endeavour to advance long-lead approvals.”

The call comes about a month after Hancock’s $600m McPhee project got the environmental all-clear from the Federal Government, some three years after it was first referred.

Earlier this month, the group trimmed back the proposed output and size of another planned iron ore mine, Mulga Downs, in a bid to appease State regulators.

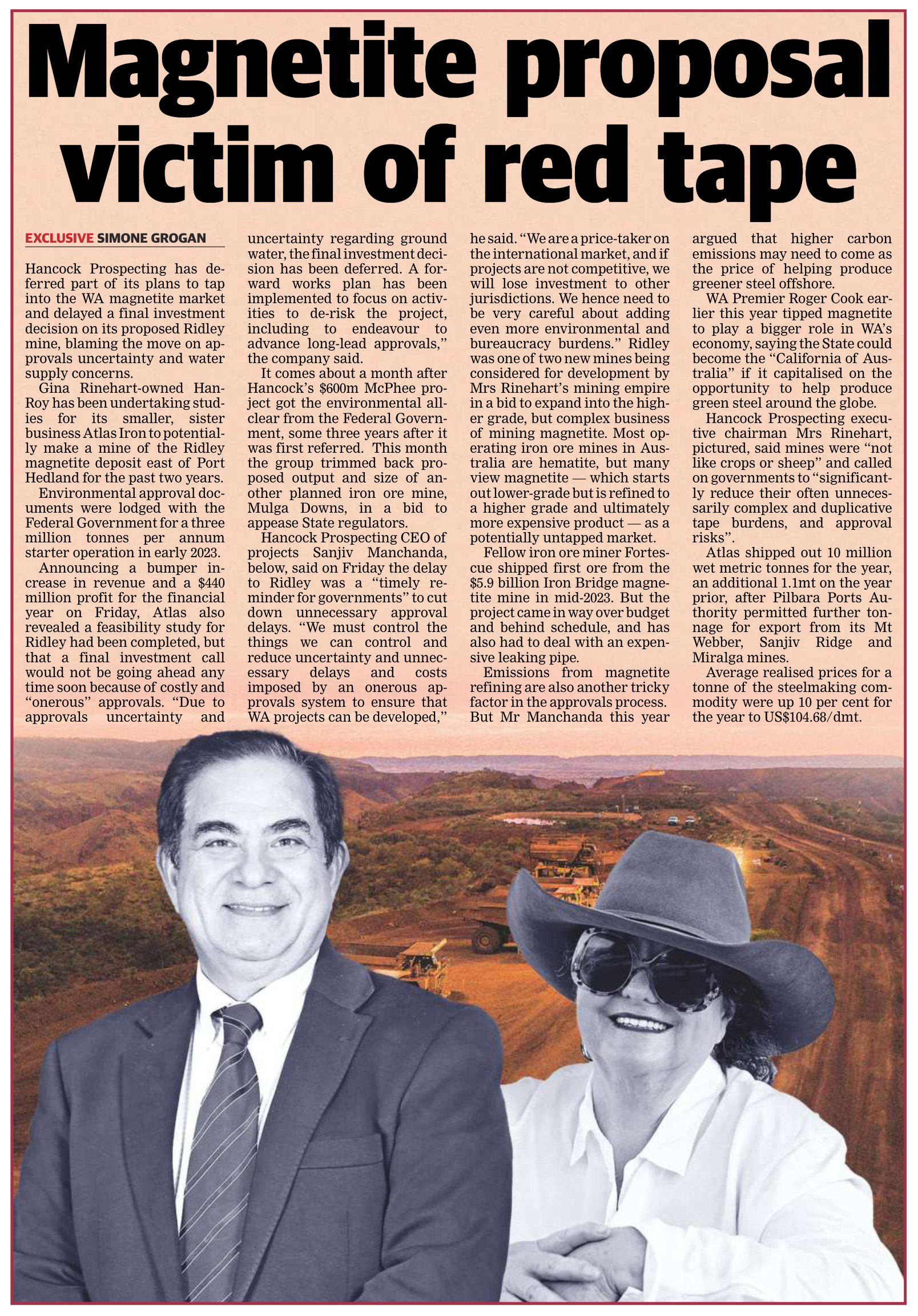

Hancock Prospecting chief executive projects, Sanjiv Manchanda said on Friday the delay to Ridley was a “timely reminder for governments” to cut down unnecessary approval delays.

“We must control the things we can control and reduce uncertainty and unnecessary delays and costs imposed by an onerous approvals system to ensure that West Australian projects can be developed,” he said.

“We are a price-taker on the international market, and if projects are not competitive, we will lose investment to other jurisdictions. We hence need to be very careful about adding even more environmental and bureaucracy burdens.”

Ridley was one of two new mines being considered for development by Mrs Rinehart’s mining empire in a bid to expand into the higher-grade, but complex business of mining magnetite.

Most operating iron ore mines in Australia are hematite, but many view magnetite — which starts out lower-grade but is refined to a higher-grade and ultimately more expensive product — as a potentially untapped market.

Fellow iron ore miner Fortescue shipped first ore from the $5.9 billion Iron Bridge magnetite mine in mid-2023. But the project came in way over budget and behind schedule, and has also had to deal with an expensive leaking pipe.

Emissions from the magnetite refining process are also another tricky factor to get around from an approvals perspective.

But Mr Manchanda earlier this year argued that higher carbon emissions may need to come as the price of helping produce greener steel offshore.

WA Premier Roger Cook earlier this year tipped magnetite to play a bigger role in WA’s economy, saying the State could become the “California of Australia” if it capitalised on the opportunity to help produce green steel around the globe.

Mrs Rinehart said mines were “not like crops or sheep” and called on State and Federal governments to “significantly reduce their often unnecessarily complex and duplicative tape burdens, and approval risks”.

Atlas shipped out 10 million wet metric tonnes for the year, an additional 1.1mt on the year prior, after Pilbara Ports Authority permitted further tonnes for export from its Mt Webber, Sanjiv Ridge and Miralga mines.

Average realised prices for a tonne of the steelmaking commodity were up 10 per cent for the year to $US104.68/dmt.